The FBR Digital Invoicing Setup in Pakistan is transforming how businesses handle taxation. Since the Federal Board of Revenue (FBR) has made digital invoicing mandatory, it’s essential for every registered business to understand this process.

Although it might seem technical at first, the steps are simple and logical. Moreover, once implemented, the system reduces errors, increases transparency, and ensures compliance. Let’s go through the process step by step so you can get started confidently.

Step 1: Register on the FBR Portal

To begin your FBR Digital Invoicing Setup in Pakistan, you first need to register your business on the FBR IRIS portal. After logging in with your NTN and password, carefully review your business details.

Ensure your address, CNIC, and contact information are correct. Consequently, this accuracy helps your integration process run smoothly later. In addition, complete registration creates a verified business profile that allows communication with the FBR’s invoicing system.

Step 2: Obtain FBR Integration Credentials

Once registration is complete, the next step is to obtain your POS Integration credentials. These include your Integration ID, API key, and branch identifier. With these details, your POS software can securely connect to the FBR server.

Most FBR-compliant POS systems—such as OneClickPOS.pk—simplify this process. They assist you in generating these credentials correctly and ensure your system is ready for data transmission. Therefore, using a reliable software provider saves both time and effort.

Step 3: Connect Your POS System to FBR

Now it’s time to connect your POS or ERP system with the FBR’s database. Follow these steps:

- Enter your API key and Integration ID in your POS settings.

- Test the connection using FBR’s sandbox mode.

- Once everything works perfectly, switch to live mode.

After integration, every transaction will automatically generate a digital invoice and send it to the FBR server. As a result, your sales data will always remain accurate and compliant. In addition, your reports will update automatically without any manual input.

Step 4: Generate FBR Digital Invoices

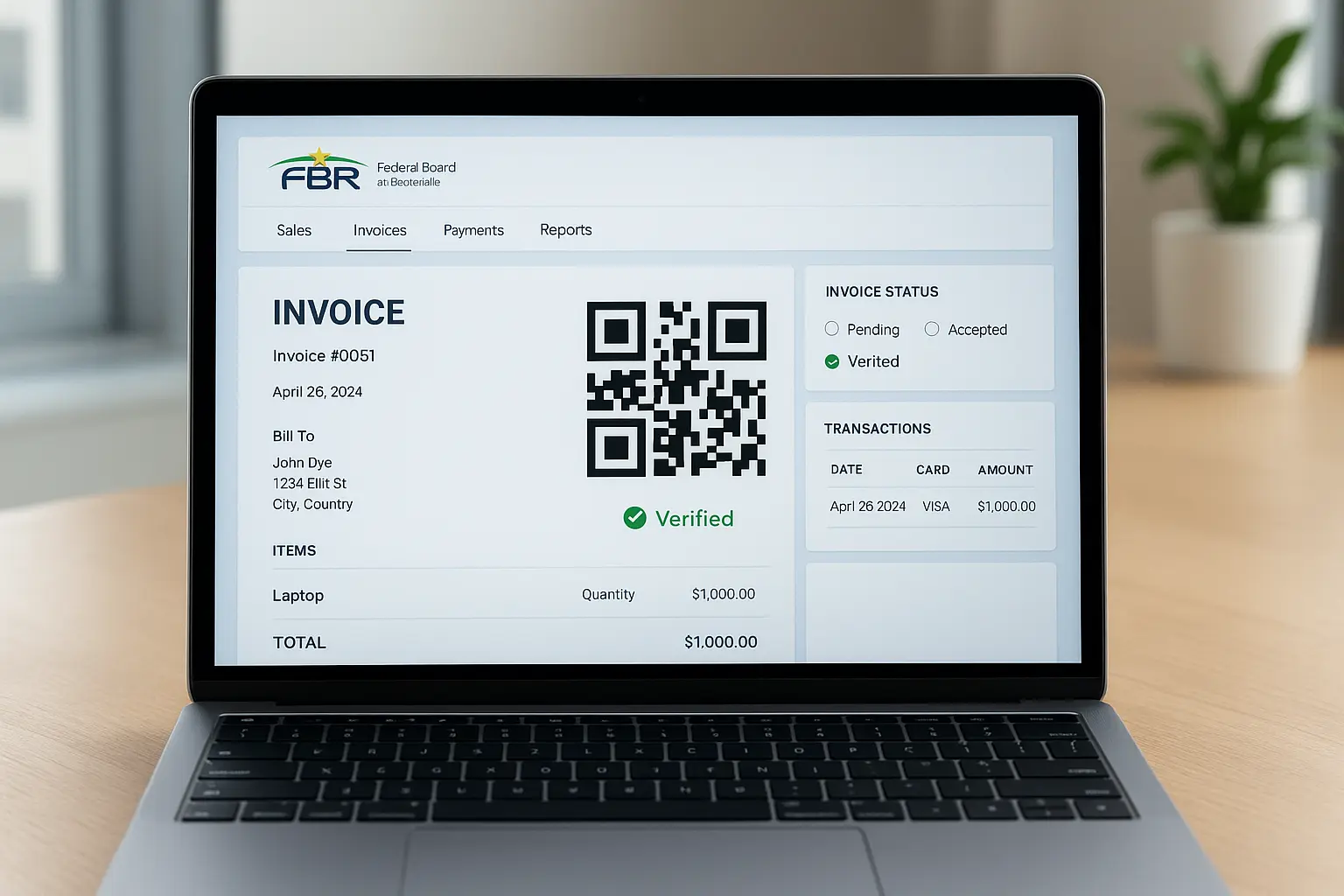

Once your system is connected, it will begin producing FBR Digital Invoices. These invoices include essential details such as the FBR logo, unique invoice number, QR code, and tax breakdown.

Moreover, customers can scan the QR code to verify the invoice authenticity instantly. Consequently, this builds trust and ensures full transparency in your business transactions. With each invoice being automatically uploaded to the FBR database, compliance becomes effortless.

Step 5: Verify Your Digital Invoices

After integration, it’s important to verify that your invoices are successfully recorded in the FBR system. To do this, open the FBR Tax Asaan app or visit the invoice verification page.

Then, simply scan the QR code printed on your invoice. If it appears in the FBR database, your FBR Digital Invoicing Setup in Pakistan is functioning correctly. Furthermore, routine verification helps identify any synchronization issues early and maintains your business’s credibility.

Step 6: Stay Updated with FBR Regulations

The FBR frequently updates its digital invoicing policies. Therefore, you should regularly check the official FBR website for new circulars and notifications.

In addition, make sure your POS software remains up to date. Updated systems reduce technical errors and stay compatible with any new compliance rules. Finally, training your staff on these updates ensures consistent accuracy across all operations.

Benefits of FBR Digital Invoicing Setup in Pakistan

Adopting FBR Digital Invoicing has several long-term benefits. For instance, it promotes transparency, reduces errors, and improves financial accuracy. Furthermore, it ensures your business meets all government regulations without unnecessary paperwork.

As a result, you can focus more on growth and customer service instead of worrying about compliance. Overall, digital invoicing is not just a requirement—it’s a smarter way to manage your business operations efficiently.

Conclusion

Completing your FBR Digital Invoicing Setup in Pakistan ensures your business stays compliant, transparent, and future-ready. The process may seem detailed, but each step—from registration to verification—builds a strong foundation for efficient digital tax management.

At OneClick, we simplify this process for you. Our FBR-integrated POS software automates every step, including digital invoice generation, tax reporting, and system synchronization. Therefore, you can focus on your business growth while we handle the compliance side.